In a world where digital banking has become the norm, users expect a seamless, secure, and ad-free experience when managing their finances. Unfortunately, it seems that not all banking apps are adhering to these expectations. JazzCash, one of Pakistan’s leading mobile banking services, has recently come under scrutiny for incorporating Google AdSense advertisements within its app—a move that raises significant concerns about the app’s commitment to user trust and security.

The Unexpected Presence of Ads in a Banking App

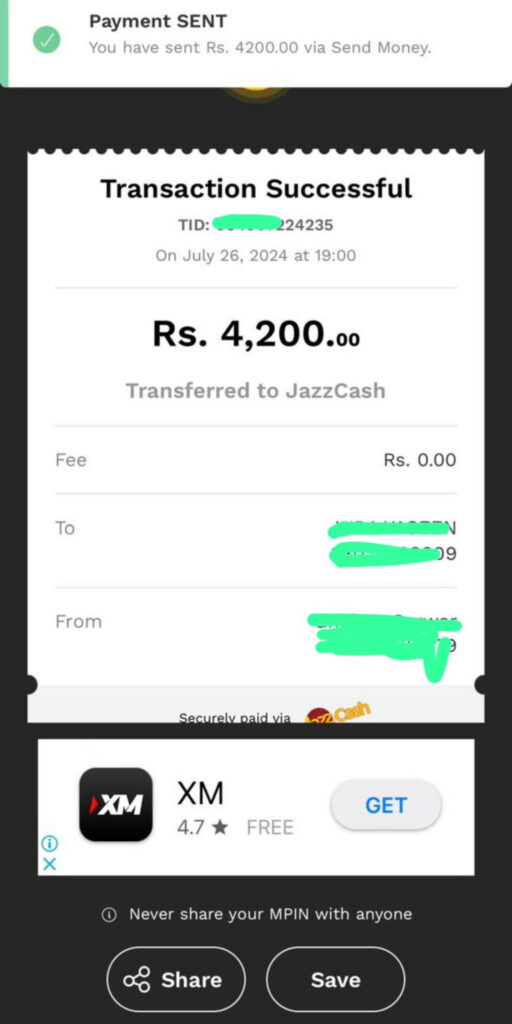

When users download a banking app, they anticipate a platform dedicated to providing financial services, not one cluttered with advertisements. Traditionally, banks and financial institutions have avoided placing ads on their apps to maintain a professional and secure environment. This decision is rooted in the understanding that ads can create distractions, dilute user experience, and, most critically, introduce potential security risks. Yet, JazzCash has chosen to deviate from this norm by integrating Google AdSense into its app.

This move by JazzCash is not only unusual but also troubling. The presence of ads on a banking app can lead users to question the app’s reliability. Banks are trusted institutions, and any element that could compromise that trust—such as third-party ads—should be avoided. By allowing ads on its platform, JazzCash may be inadvertently eroding the trust it has worked hard to build with its users.

Why Ads on a Banking App Are a Red Flag

The inclusion of advertisements in a banking app raises several red flags, especially concerning security and user experience. Banking apps are expected to be secure environments where users can perform transactions, check balances, and manage accounts without worrying about potential security threats. However, the introduction of ads, especially those served by third-party networks like Google AdSense, opens the door to several risks.

1. Potential for Fraudulent Schemes

Google AdSense ads are often targeted based on user behavior, and while most ads are benign, there’s always the risk of malicious ads slipping through the cracks. These could potentially lead users to phishing sites or other fraudulent schemes, which is especially concerning in a banking context where users’ financial information is at stake. JazzCash’s decision to incorporate these ads could expose users to unnecessary risks that should be strictly avoided in financial platforms.

2. Erosion of Trust

Trust is the cornerstone of any banking relationship. Users trust their banks to protect their money, safeguard their personal information, and provide a secure platform for managing their finances. The presence of ads within the JazzCash app can erode this trust. Users may begin to question the app’s integrity and wonder if their financial information is truly safe. After all, if JazzCash is willing to compromise user experience by serving ads, what else might they be compromising?

3. A Distraction from Core Services

A banking app’s primary function is to provide financial services. Advertisements, however, serve as a distraction from these core services. Users should not have to navigate through ads to check their balances or transfer funds. By prioritizing ad revenue over user experience, JazzCash risks alienating its user base and pushing them towards alternative banking apps that offer a cleaner, ad-free experience.

Is This a Company Policy or a Rogue Decision?

The decision to incorporate ads into the JazzCash app raises serious questions about the company’s direction and internal policies. Is this part of a broader strategy by Jazz to generate additional revenue streams, or is it a rogue decision made by the app’s management without proper oversight? These are questions that Jazz needs to answer.

1. A Desperate Move for Revenue?

If the decision to include ads was made at the corporate level, it could indicate that Jazz is struggling financially and is looking for alternative revenue streams. However, this strategy could backfire by driving users away. Banking apps are expected to generate revenue through transaction fees, interest, and other banking services—not through ads. If Jazz is resorting to ad revenue, it might suggest that the company is in a more precarious financial position than it would like to admit.

2. A Decision Made Without Approval?

On the other hand, if the inclusion of ads was a decision made by the app’s management without higher-level approval, it raises concerns about the company’s internal oversight and governance. Such a significant change to the user experience should have undergone rigorous scrutiny and approval from top executives. If this was not the case, it indicates a lack of control within the organization, which could have broader implications for how Jazz is managed.

The Bigger Picture: Impact on the Banking Sector

JazzCash’s decision to include ads in its app doesn’t just impact its users; it also has broader implications for the digital banking sector in Pakistan. As one of the leading mobile banking services in the country, JazzCash sets a precedent for other banking apps. If other financial institutions follow suit and begin incorporating ads into their platforms, it could lead to a deterioration of trust across the entire sector.

1. Setting a Dangerous Precedent

JazzCash’s move could encourage other banks and financial institutions to explore similar revenue-generating strategies. This could lead to a race to the bottom, where user experience and security are sacrificed in favor of short-term profits. The banking sector relies heavily on trust, and any actions that undermine this trust could have long-lasting consequences.

2. Impact on Digital Banking Adoption

The introduction of ads on banking apps could also slow down the adoption of digital banking in Pakistan. Many users are already hesitant to move away from traditional banking methods due to concerns about security and privacy. The presence of ads—especially those that could lead to fraudulent sites—will only reinforce these concerns, making users less likely to adopt digital banking services.

Questions JazzCash Needs to Answer

Given the potential risks and the significant impact this decision could have on the banking sector, JazzCash owes its users some answers. Here are a few questions that JazzCash needs to address:

1. What was the rationale behind incorporating ads into the app?

Was this decision made as a desperate attempt to generate additional revenue, or is it part of a broader strategy? JazzCash needs to clarify why it chose to include ads and how it aligns with its commitment to providing secure and reliable banking services.

2. Was this decision approved by top executives?

Did the decision to include ads receive approval from Jazz’s highest levels of management, or was it implemented by the app’s management without proper oversight? Transparency is key here—users deserve to know if this decision reflects the company’s official policy.

3. How does JazzCash plan to mitigate the potential security risks?

Given the inherent risks associated with third-party ads, what steps is JazzCash taking to ensure that its users are not exposed to fraudulent schemes or malicious ads? The company must outline the measures it has in place to protect its users.

4. What impact does JazzCash expect this decision to have on its user base?

Has JazzCash considered the potential backlash from users who may be turned off by the presence of ads? The company should provide insights into how it plans to retain user trust and loyalty in light of this controversial decision.

1 Comment